Workshop

员工福利费个税征管与企业税务处理实践探讨

因为目前报名人数已满,故11月28日10:00分之后注册的同行将进

入Waiting List,对于给您带来的不便,F-Council深表歉意!

若有任何疑问可随时联系客服人员!

本期价值要点:

● 帮助您深度了解上海市个税征管现状以及征管力度

● 结合《常见员工福利税务处理》表格,了解和借鉴其他同行的福利费发放和税务处理模式,探索最佳实践经验

● 通过与同行和专家的交流,借鉴其经验和意见,让您更好的与税局沟通

同行的困惑:

——税局征管态度及政策理解上的困惑:

● 关于2%手续费的问题,应该如何申请?手续费可以如何利用?现在是直接计入营业外收入是否合理?有没有明确规定?

● 高收入人群已经多年纳入加强征管的范畴,那么今年的高收入人群的个税征管现状以及未来的趋势如何?

● 在出差费的额度上面我们感到有些困惑,去咨询税务局,目前也没有相关政策的规定,那么多少额度是比较安全的范围呢?

● 我们经常听到很多福利费的发放方式和税务处理是可以和税局沟通的,但是在沟通的时候税局会拿出很老旧的文件或政策,例如饭贴,税局说一天只能补助8块钱,申请的流程也是相当复杂。我们有没有什么办法或是技巧能够有效的和税局进行沟通呢?

——企业实际操作中的争议及“模糊点”:

● 员工出差费用报销时,涉及到的问题。实报实销是否有时间规定?上个月的费用这个月报销是否算作实报实销?餐费的报销用交通的发票来抵是否可以算作实报实销?

● 有些涉及金额不大,但是数目很多的情况下我们会选择直接加入到企业的成本中,就像手机费,用多少报多少,但是没有代缴个税,是否存在风险?

● 手机通讯费的报销发票应该开具个人抬头还是公司抬头?

● 公司目前对员工的一些费用采取实报实销制度,但是企业的员工经常拿些“乱七八糟”的发票来报销,或者直接说发票丢失要求报销费用。遇到这种情况我们财务人员就比较纠结了,要怎么与员工沟通,或是有没有比较有效的内控制度可以减少或是杜绝这种情况的发生?

活动特邀分享嘉宾

主管官员 上海市某区税务局

田雯燕(Eva)高级经理 致同(北京)税务师事务所有限责任公司上海分所

Eva现任Grant Thornton人力资源及全球移动服务部门高级经理,其在超过十二年的人力资本和税务专业服务工作中,她为众多跨国企业提供中国个人所得税的税务合规性、咨询和筹划服务.

曾为众多的500强跨国公司和国内公司提供相关服务,其服务的客户包括银行、金融保险、汽车、航空、化工、房地产、快速消费品、服务业和制造业等。

陈鹏志(Peter) 高级税务部经理 致同Grant Thornton

陈先生曾为众多的跨国公司提供税务和商业管理咨询服务,包括税务合规性、投资结构筹划、税务咨询和企业兼并中的税务尽职调查等。陈鹏志在企业兼并领域拥有丰富的经验,为各种在中国投资的企业提供税务尽职调查和税务健康检查,以帮助企业识别和评估潜在的税务风险。在这次活动中peter会为我们会员解决一些福利费涉及的企业所得税方面的困惑

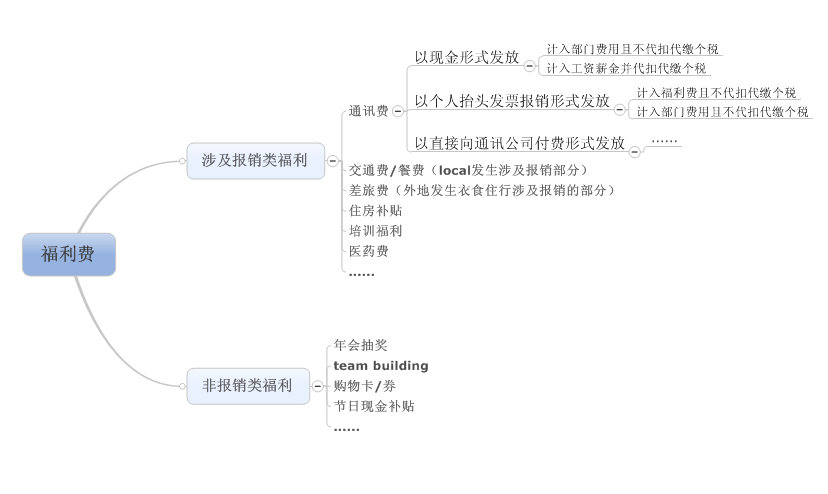

涉及的福利项目如下:

流程安排

流程安排13:00 签到

13:30 官方视角:上海市个税征管现状以及征管力度解析

—中籍员工涉及的福利费的征管态度,判定标准与合理范围

—2014年重点征管项目回顾与举例

—中籍员工涉及的福利费后续征管工作部署

—其他个税征管热点问题解析

● 高收入人群的个税征管现状以及未来征管趋势

● 2%手续费返还的有关问题(申请流程及条件、资金的使用规定等)

14:45 茶歇

15:00 非报销类福利的常见税务处理方式以及筹划空间的探讨

年会抽奖、team building、购物卡/券、节日现金补助及其他实物奖励

—企业常见发放方式列举及利弊分析

—常见税务处理方式解析以及风险评估

—专家建议及筹划空间探讨

—2014年税务稽查力度以及常见政企争议

15:45 涉及报销类福利的常见处理方式及筹划空间探讨

通讯费、交通费、差旅费、餐费、医药费、住房福利、培训福利等

—企业常见发放方式列举及利弊分析

—常见税务处理方式解析以及风险评估

—实报实销福利的操作方式解析及税务风险规避

—专家建议及筹划空间探讨

—2014年税务稽查力度以及常见政企争议

16:30 企业实操经验分享交流

—结合《常见员工福利税务处理》表格,了解和借鉴其他同行的福利费操作模式

—小组讨论

● 福利费的实际发放方式及税务处理

● 企业内部管理制度交流

● 在与税局的沟通中常出现的分歧点以及解决方式

—中介点评

(此环节通过《常见员工福利税务处理》表格的对照和填写,帮助大家快速了解其他企业对于福利费的发放及税务处理。参会同行可以在小组讨论环节集思广益,扬长避短,真正做到“安全,有效”的发好福利)

16:50 Q&A

17:00 活动结束

F-Council近期举办过的“个税”相关活动回顾

2014年11月26日个人所得税的筹划-各类福利费的税收筹划

2014年6月20日 中、外籍员工福利费个税筹划——光明正大“少”交税

2014年6月18日个人所得税的筹划和合规---中,外籍员工福利费(深圳)

The Tax Treatment of Employee Benefits and IIT Tax Collection

KEY VALUE POINT:

●Depth understanding about current situation of Shanghai administration work on IIT

●Reference trick through the table of tax treatment and the analysis of employee welfare

●Let you have a good communication with Tax Bureau

QUESTIONS FROM PEERS:

Confusions on Tax Policy and Tax Bureau’s Attitude

●How to apply for the 2% fee refund? Are there some regulations?

●How about the status of IIT collection and management of this year and the trend of the future of High income groups?

●Are there some relevant provisions about travel expenses? What’s the attitude of tax bureau?

●Some subsidies are difficult to apply. Can we communicate with the tax bureau effectively? Is there any methods?

Confusions on enterprise practice

●What is the real concept of accountable? Is it right to use the transportation invoices reimburse dinner costs?

●We offer our employees a mobile phone fee reimbursement but without withholding IIT, is there a risk?

●The title of Mobile phone charges invoices shall be personal or company?

●How to carry out tax planning about Chinese employees?

SPEAKER:

Peter Chen Senior Tax Manager – Grant Thornton Shanghai

Peter Chen is a senior tax manager of Grant Thornton's Shanghai office. Peter has experience in world famous accounting firms for about 9 years, and has full experience of corporate tax and transaction tax.

Eva TianSenior Tax Manager – Grant Thornton Shanghai

Eva Tian is a senior manager of Global Mobility Services (“GMS”) team. During her twelve-year career in human capital and taxation areas, Eva has rich experiences in providing PRC individual income tax compliance services, advisory services and tax planning for many multinational companies.

Agenda

13:00 Sign In

13:30 Speech of Official:The Current Situation of IIT Collection

-IIT Tax collection and management attitude of Chinese employees

-Review the key events of tax collection and management in 2014

-Follow-up works about tax collection and management

-The other hot topics

●Tax collection and management about high income groups

●2% fee refund

14:45 Tea Break

15:00 Discussion on tax treatment of non reimbursement kind of welfare

(Luck draw in Annual meeting/team building/shopping card/Holiday cash assistance/Goods Reward)

-list some common payment methods of employee benefits and analyze the pros and cons

- Risk assessment of tax treatment

-Experts recommending and Tax planning

-Tax inspection dynamics in 2014 and Disputes between government and enterprises

15:45 Discussion on tax treatment of welfare which need invoice

-list some common payment methods of employee benefits and analyze the pros and cons

-Risk assessment of tax treatment

-Solve the problem of reimbursement

-Experts recommending and Tax planning

-Tax inspection dynamics in 2014 and Disputes between government and enterprises

16:30 Enterprise operation experience shared

-Reference trick through the table of tax treatment and the analysis of employee welfare

-Group discussion

●The actual payment mode and tax treatment of welfare funds

●The enterprise internal management system

●Bifurcation point on communicate with Tax Bureau

-Expert comments

16:50 Q&A

17:00 ending

| 姓 名:Judy Jin | 客服热线:400 820 2536 |

| 非会员报名邮箱:/ | 会员报名邮箱:cs@fcouncil.com |

银行名称:招商银行股份有限公司

开户行:招商银行股份有限公司上海虹桥支行

帐户:121908638710202

1、如确认参加此活动,请尽快报名以便我们为您安排席位; 2、如您有相关问题希望与活动嘉宾互动,请尽快将您的问题提交给F-Council,我们将尽量为您安排; 3、活动确认函将于活动前1-3个工作日发送至参会代表邮箱,届时请注意查收,若未如期收到请及时致电咨询; 4、F-Council不排除活动嘉宾因临时时间变动无法如期出席的可能性,如发生类似情况,我们将第一时间通知参会代表; 5、F-Council对上述内容具有最终解释权。