|

服务热线:400-820-2536 |

|

服务热线:400-820-2536 |

2014年上海年底关帐活动(第一期)

——要点前瞻及风险提示

本期价值要点

邀请资深中介梳理2014年底关账相关重要政策,结合企业关账前期的准备工作、关注要点,事项检查清单,并通过税务政策及会计调整实务两方面进行深度分析,双管齐下解决年底关帐的普遍性实操难点!为汇算清缴做好充足的准备

活动要点:

●分享不同行业关于关账工作的“检查清单”准备,如何整合全年数据,设置合理的关账起始点以及关账工作的要点明细

●盘点上海地区税务稽查的重点,解析如何应对日渐严苛的税务稽查工作,做好关账,将风险扼杀在摇篮中

●随着营改增的波荡起伏,据悉,2015年年底将完成所有行业营改增的转型,该举措对年底关账工作会有哪些影响?企业税收优惠政策该如何运用到实际工作中?

●所得税收入确定方面,如何从合同签订期间来考虑,来规避特许权使用费带来的风险。

●通过税务政策及会计调整实务两方面深度解析,解决年底关帐的普遍性实操难点,为未来汇算清缴做好扎实准备

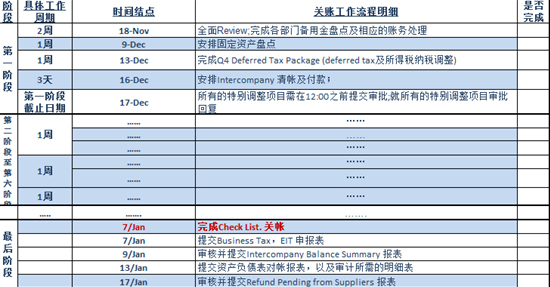

情景一(企业关账check list):

情景二(税前扣除):关于研发费用的加计扣除,今年和去年的要求不一样,以前预缴的时候是按照实际的花费来申报的,现在是根据研发费用的预计扣除数在预缴的时候做研发费用的加计扣除,一般企业的系统里设置是无法满足到凭证的要求,必须要手工来操作,如何降低这方面的工作量,提高效率。

情景三(收入确认):关于预收款税法规定是需要售后确认并缴纳增值税的。公司目前都是向客户收取预付款,实际开票是滞后的,所以在收入确定的时间节点上存在担忧。比如项目跨周期较长,可能要两三年,一般是到了一个周期后再开发票如第一期接着是第二期。如果涉及客户预付的这笔金额非常大,那么该如何应对税务机关的审查?

情景四(税务稽查):今年稽查形式非常严峻,对医药行业的影响特别大。比如关联方的往来如何记账,是确认收入、确认成本还是计入往来?涉及到这个费用是待定还是判定为服务费,具体该如何入账,如何与税会差异相联系?

情景五(税务稽查):实务中很多企业会通过会务费的形式处理相关的促销费用,比如做新产品的展示,类似于新产品发布会,确实是为会务做准备的但是一旦被税局稽查,会被要求重新列支到业务宣传费。在

平时记账及年底关账中如何处理这类“灰色地带“?如何尽可能地在合规的情况下规避税务风险?为企业争取利益最大化。

活动特邀分享嘉宾

叶永青 全国税务技术中心、转让定价服务组 合伙人 德勤华永会计事务所

叶永青先生作为德勤上海的合伙人,拥有超过14年的专业税务服务经验,其中包括12年以上的转让定价服务经验,在包括转让定价同期资料准备、转让定价纳税争议解决、预约定价和国际税务筹划等服务领域具有丰富经验和积累。

除转让定价领域外,叶先生亦作为德勤全国税务技术中心的合伙人,主要负责帮助税务部同事解决关于中国和跨国税务的疑难问题,包括转让定价和国际税务问题的税务筹划等,叶先生曾负责就多个复杂税务技术问题与企业和税务机关进行沟通谈判。

叶先生曾服务客户涵盖众多行业,例如制造业,批发零售行业,金融业,房地产行业等。在2008年,叶先生被派往德勤美国工作18个月,期间专注于国际转让定价税务工作。除此之外,叶先生还在多所大学的税务硕士项目中担任校外导师,并且长期担任税务论坛的演讲嘉宾.

叶先生是中国注册会计师,同时也拥有中国律师职业资格。

陆怡 合伙人 审计部专业技术部 德勤华永会计事务所

陆怡女士于1996年加入德勤,在专业技术部的工作包括为审计项目提供协助,为企业适应本地法规要求、海外兼并、上市及融资目的提供审计服务,以及为事务所内外提供培训讲座等,所涉及行业包括房地产开发、采矿、能源及各类制造业。

Kiki You 财务经理 Boston

专注服务于注塑行业,曾在Omni、Nypro等外资企业,担任财务主管,财务经理职位。她从事过出纳,应收应付,固定资产,税务,成本,总账等职务,是一位从基层成长起来的中层管理人员。Kiki也曾独立进行两家新公司的注册成立,有外商投资新公司的注册成立经验。

Isia liu 财务经理 国旅运通航空服务有限公司

Isia liu 于2012年加入国旅运通(一家专业的商务旅行差旅管理公司),目前负责公司的财务和税务和内控管理。在国旅运通之前曾在会计师事务所、生产企业和电商等行业有过10多年的从业和管理经验。

流程安排

9:00 签到

9:30 2014年底关帐相关重要政策盘点——企业所得税类关于减免税、税前扣除、申报管理项等最新解读

10:45 茶歇

11:00 涉及2014年底关帐相关重要政策盘点-增值税、个税、消费税等

11:30 Panel discussion:企业年底关帐的整体工作计划——财务账目的全面审核 &检查清单

—关帐前的税务评估

(自我纳税评估、关联交易的税务管理等)

—合理设置关账的起始点以及具体工作安排

(细分工作安排、协调相关工作人员、关账check list)

—财务账目的全面审核

(高风险挂账的处理、流程和业务的合规性核查)

—与年后汇算清缴的衔接

(递延所得税的处理 、规避风险、提高效率)

(此环节将分行业邀请企业嘉宾进行年底关帐经验交流,通过分享各自企业的“检查清单”准备、部门协调与沟通、以及如何合理设置关账起始点等,帮助大家快速了解年底关帐所涉及工作的方方面面及企业实操经验)

12:00 午餐

13:30 常见收入确认实务解析(税会差异、会计调整实务解析)

—计税收入的确认与计量(销售货物、提供劳务、转让财产)

—股息红利等权益性投资收益(利息、租金、特许权使用费)

—不征税收入和免税收入

—其他收入(出租、出借包装物的收入,产、委托加工产品视同销售的收入等)

14:00 税前扣除关帐实务(税会差异、会计调整实务解析)

—企业资产损失所得税税前扣除实操要点解析

(长期投资、固定资产折旧费用、待摊费用摊销、固定资产破损报废、盘点亏损等)

—员工薪资福利(工资、福利、年底奖金、分红等)

—展业促销礼品/特定客户礼品(视同销售、买一增一)

—业务招待费、广告和业务宣传费及公益性捐赠扣除实操要点解析(如何设定合同条款界定模糊费用)

—总帐下递延所得税与预提所得税扣除税务管理

(预计负债和递延所得税负债、待摊费用、计提职工福利费、广告宣传费、业务费等)

—其他不得所得税税前扣除的项目

—关于以前年度发生应扣未扣支出的税务处理问题

15:30 实盘操练: 年底关帐税收优惠政策解析与筹划

—2014年稽查形式对年底关账产生的影响

(盘点上海地区税务稽查的重点,解析如何应对日渐严苛的税务稽查工作)

—税收优惠类

(高新技术企业认定、研发费用加计扣除、抵扣应纳税所得额、减/抵免税额等)

案例分享1: 科技创新型企业(软件企业、集成电路企业等高新技术企业)

案例分享2: 其它行业税收优惠政策

—税前扣除类

(税前扣除规定与企业会计处理、关联方交易、模糊费用界定等相关税务管理及调整实务解析)

案例1:工资薪金及相关支出的税前扣除

案例2:广告及业务宣传费

(此环节将针对企业提及的常见操作项目,通过案例分享以及让参会者亲自参与的形式,帮助大家快速掌握年底关帐的实操精髓)

16:00 互动问答

16:30 活动结束

KEY VALUE OF THE EVENT

The event will invite senior agency to comb the important related policy at the end of this year . Combined with preparatory works , concern main point ,items checklist at the enterprise closing prophase and doing in-depth analysis in the Tax Policy and two accounting practice adjustments, both solve the universality of difficulty of the practical operation of closing at the end of the year. Make adequate preparations for the final settlement .

Key point

Sharing “check list” preparatory woks on closing in different industries. How to integrate the data throughout the year ,set up an reasonable closing starting point and a main point

Take stock of tax audit focused on the SH area. Resolve how to deal with the increasingly stringent tax audit work. Do a good job of closing , for this,risk will be killed in the bud.

With the ups and downs of the reform program to replace the business tax with a value-added tax, it is said that by the end of 2015 all business will complete the transformation, what effects does it has on closing, how to use preferential tax policy to real work.

In terms of income tax revenue to determine, considering the contract time,how to evade the risks of royalty

Through the deep analysis of tax policies and adjustment to accounting practices, resolve the difficulties of the universal and practical operation on closing, to prepare for final settlement in the future.

Guests invited to share

Bill Ye Transfer Pricing / National Technical Center Partner Deloitte Shanghai

As a Partner specializing in tax and transfer pricing, he has more than 14 years tax service experience in Deloitte with more than 12 years extensive experience in contemporaneous transfer pricing documentation, transfer pricing audits, advanced pricing agreements, and international tax planning.

In addition to his transfer pricing experience, he has also worked as tax partner in the National Tax Technical Center of Deloitte China to assist Deloitte tax team to deal with comprehensive and complex domestic and international tax issues. He has been responsible for negotiation and communication with tax authorities in many complex tax dispute cases.

He has served more than 40 clients in a wide variety of industries, such as manufacturing, whole sales and retailing, financial, real estate, etc. In 2008, he was sent by Deloitte China to work in Deloitte US firm for a 18 months period focusing on international transfer pricing practice. He is also an active speaker in many tax event and seminar including tax programs with various Universities.

Lisa Lu Partner Technical Deloitte

Lisa Lu joined Deloitte China in 1996. She provides professional support in resolving technical issues and delivers seminars on professional knowledge both inside and outside the firm. Her professional experience also includes managing local statutory audits, advising on cross-border mergers and acquisitions and public listing and financing. Lisa has served a host of clients from a wide range of industries including real estate, mining, energy and resources, and manufacturing.

EVENT SCHEDULE

9:00 sign in

9:30 Make an inventory of the important related-policy at the end of the year - preferential tax and filing management- the preferential tax class

An annoncement of non-resident enterprises equity transfer for special tax treatment by the state administration of taxation .

(State Administration of Announcement No.72 of 2013,Are non-resident enterprises equity transfer can really enjoy the benefits. How to proceed with the preparation of materials?)

State Administration of Taxation‘s announcement on commercial retail enterprises inventory ‘s tax deduction issues.

(State Administration of Taxation Announcement No. 3 2014 . Nomal loses in inventory reporting, inventory single (individual) loss more than 5 million yuan of need to be declared .)

State of Administration on Enterprise income tax amount of taxable income issues announcement

(State Administration of Taxation Announcement No. 29 of 2014. income tax treatment of assets which enterprise received the shareholder ; the enterprise income tax treatment of impact of depreciation of fixed assets.)

Shanghai local tax bureau on modifying the software industry and integrated circuit industry preferential enterprise income tax matters management announcement

[2014] Shanghai land tax by the 15th, new requirements for R & D expenses caculating and deducting

Declaration Management

State Administration of Taxation on standard according to the actual management institutions implementing resident enterprise about problem announcement.

(State Administration of Taxation Announcement No. 9 of 2014; Combined with the relevant policy early, illustrate the significant impact on residents pay taxes "finds" problem, To do a good job of liquidation preparation)

State Administration of Taxation on Special Tax Adjustments monitoring and management issues notice

(State Administration of Taxation Announcement No. 54 of 2014, Taxpayers how to get special tax adjustment concluding observations? Whether the investigation may be exempted from the tax authorities to adjust after self-adjusting back taxes?)

Released on the law of the People's Republic of China on enterprise income tax monthly (quarterly) prepayment pay tax declaration form (2014 edition), and other statements of a public announcement

(State Administration of Taxation Announcement No. 28 of 2014,applicable to tax resident enterprises auditing the implementation of enterprise income)

How to do the work Closing by braches of trans-regional operated enterprises that pay taxes.

10:45 Tea break

11:00 Take stock of related important policy involving closing at the end of 2014- Value added tax, income tax, consumption tax, etc

Personal income tax: on the implementation of differentiated dividends personal income tax policy

An announcement of State Administration of Taxation on good occupational pension annuity personal income tax collection and management work

(The total tax [2013] No. 143 issued)

Combined with development trend of the individual income tax and grim trend of high-paid personnel tax collection and management, analylise the effect of tax policy on Closing and final settlement

Value added tax:Camp to add" series policy (caishui [2014] no. 43) (State Administration of Taxation Announcement No. 42 of 2014 State Administration of Taxation Announcement No. 26 of 2014)

(combined with relevant policies, reveal the great influence of enterprises closing work by 2014 "Camp changed by" new situation)

Consumption tax:An notification :Naphtha, fuel oil refund (exemption) consumption tax management procedures (Trial)

(Taxes total letter [2014] no. 412;Whether the consumption tax reform will have indirect effects on downstream companies such as the chemical industry.)

11:30 Panel Discussion: Overall work plan of business by the end of Closing--- Audit & Checklist comprehensive financial accounts

the tax assessment before Closing

(self-tax assessment, related transactions management and others)

properly setting the starting point of closing and specific working arrangements

(Subdivision work arrangement、coordinating relevant staff, Closing check list)

Comprehensive audit of the financial accounts

(The treatment ,process and business compliance verification of high-risk account)

The convergence of final settlement after the year

avoidding risk and improving efficiency of deferred income tax treatment

This link will include Inviting corporate guests in different industry exchange of experience of Closing at the end of the year. By sharing each enterprise “check list” preparation ,coordination and communication of department and how to set the starting point of Closing, help you quickly understand the all aspects of work and business experience in practical operation involved in Closing the end of the year.

12:00 lunch time

13:30 common revenue recognition practices analysis (the analysis of book-tax difference and Accounting adjustment practice)

Recognition and measurement of tax revenue(Sale of goods, provision of services, the transfer of property)

Dividends and other income from equity investments(Interest, rents, royalties)

Non-taxable income and tax-free income

Other income(the income of rental and loan packing material(the revenue of production, processing products regarding with sale )

14:00 Closing tax deduction Practice(the analysis of book-tax difference and accounting adjustment practice)

Key Points Analysis of Corporate income tax deduction asset losses practical operation

(Long-term investments, fixed assets depreciation expense, amortization of deferred expenses, fixed assets damaged scrap, inventory loss, etc.)

Employee compensation and benefits (Wages, benefits, end bonuses, dividends, etc.)

Exhibition promotional gifts and particular customer gifts

Key point practical analysis of business entertainment, advertising and business promotion expenses and Public welfare donation deduction (how to set the terms of the contract defining the fuzzy cost )

Deferred income tax and tax withholding income tax deducted from management under general ledger

(Accrued liabilities and deferred income tax liabilities, Prepaid expenses, Provision for employee benefits, advertising fees, service fees)

Can't the pre-tax deduction of project

Tax treatment issues about expenditure should have been withheld previous year

15:30 Firm practice: Analysis and planning for the preferential tax policy about the end Closing

The impact on the end Closing by the 2014 inspecting situation

(Inventory tax audit focused on the Shanghai area, resolve how to deal with the increasingly stringent tax audit work)

The preferential tax class

(The recognition of hi-tech enterprises, R & D expense additional deduction, deductible taxable income, Reducing/tax credit,)

Case study to share 1: technological innovation-based enterprises(Software enterprises, integrated circuits and other high and new technology enterprise)

Case study to share 2:Other industry tax incentives

Case study 1:The pre-tax deduction of wages and salaries and related spending

Advertising and business costs

(Common operation project company often mentioned ,by case sharing and personal involvement , help you quickly grasp the practical operation of the end of the essence Closing)

16:00 interactive question and answer

16:30 avtivity end

本次活动主要涉及政策:

—税收优惠类

1)国家税务总局关于非居民企业股权转让适用特殊性税务处理有关问题的公告

(国家税务总局公告2013年第72号,非居民企业股权转让是否真能享受优惠?如何着手准备材料)

(国家税务总局公告2014年第3号;正常损失以清单申报,存货单笔(单项)损失超过500万元的都需要进行专项申报)

(国家税务总局公告2014年第29号;企业接收股东划入资产的所得税处理;影响固定资产折旧的企业所得税处理)

4)上海市地方税务局关于修改软件产业和集成电路产业企业所得税优惠事项管理规程的通知

(沪地税所(2014)15号);对研发费用加计扣除的新要求)

5) 国务院部署完善固定资产加速折旧政策

—申报管理

1)国家税务总局关于依据实际管理机构标准实施居民企业认定有关问题的公告

(国家税务总局公告2014年第9号;结合早期相关政策;阐述对居民纳税“认定“问题的重要影响 ;做好汇算清缴前期准备工作)

2) 国家税务总局关于特别纳税调整监控管理问题的公告

(国家税务总局公告2014年第54号;纳税人如何获得特别纳税调整结论性意见?自行调整补税后是否可免予税务机关的调查调整?)

3) 关于发布《中华人民共和国企业所得税月(季)度预缴纳税申报表(2014年版)等报表》的公告

(国家税务总局公告2014年第28号;适用于实行查账征收企业所得税的居民企业; 跨地区经营汇总纳税企业的分支机构如何做好关账工作)

—个税:关于实施上市公司股息红利差别化个人所得税政策

国家税务总局关于做好企业年金职业年金个人所得税征收管理工作的通知(税总发(2013)143号;)

(结合个人所得税发展趋势及2014年高薪人员严峻的征管趋势,剖析个税政策对年底关账以及汇算清缴的重要影响)

—增值税:“营改增”系列政策(财税[2013]106号;国家税务总局公告2014年第42号;国家税务总局公告2014年第26号)

(结合相关政策全面解析2014年随着“营改增”的不断扩围与政策修订,对企业关账工作所产生的重要影响)

—消费税:《石脑油、燃料油退(免)消费税管理操作规程(试行)》的通知

(税总函(2014)412号 ;此项消费税改革是否会对化工行业等下游企业产生间接影响)

| 客服专线:400 820 2536 | 咨询专线:400 820 2536 |

| 咨询邮箱: | 解答邮箱:cs@fcouncil.com |

银行名称:招商银行股份有限公司

开户行:招商银行股份有限公司上海虹桥支行

帐户:121908638710202

|

Copyright © 2008-2024 协同共享企业服务(上海)股份有限公司版权所有 China Finance Executive Council (F-Council)为协同共享企业服务(上海)股份有限公司旗下服务品牌 网站备案/许可证号:沪ICP备15031503号-1 |

FCouncil |

御财府 |

||||